The country’s largest insurer Life Insurance Corporation of India (LIC) again outdid most of the competition, with new premium growth of 37.7 percent YoY at Rs 1.01 lakh crore.

Private life insurance companies collected Rs 41,627.60 crore in the April to October period, showing a 19.4 percent YoY growth.

Among listed players, HDFC Life collected new premiums of Rs 9,090.95 crore in the seven month period showing a 22 percent YoY growth. ICICI Prudential Life Insurance collected Rs 6.086.54 crore, showing a 22.9 percent growth.

SBI Life Insurance collected new premium of Rs 9,237.23 crore in the April-October period, showing a 39.7 percent growth.

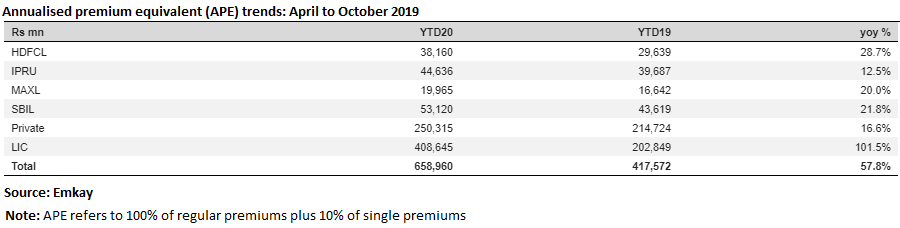

Emkay in a report said the premium growth on an annualised premium equivalent (APE) basis in October 2019 got impacted by the clubbing of holidays and the festive season. APE refers to 100 percent of the regular premiums and 10 percent of the single premiums collected during a specific period.

APE for private players grew 6.9 percent YoY while LIC saw 13.5 percent YoY growth in October 2019. Retail APE for private players grew 3.8 percent YoY while LIC reported 6.2 percent growth.

“LIC seems to be becoming aggressive with the recent launch of new products in protection (Jeevan Amar at competitive rates), limited pay endowment par policy (Jeevan Labh offered at attractive IRRs) and the possible launch of new ULIP products (communicated in a recent media interview) and thus increasing competitive intensity,” said the Emkay report.

At the end of October 2019, LIC held a market share of 70.9 percent while private insurers held 29.1 percent based on the new premium collection.