NEW DELHI: The income-tax rules seem skewed against salaried employees. While businessmen and consultants can claim exemptions against all kinds of expenses every month, for salaried employees, tax is deducted at source by the employer, which significantly lowers the take-home pay.

Is there a way to bring about a level playing field? A good way forward is by increasing standard deduction — not by a token amount, but substantially. Standard deduction is the amount that gets subtracted from your taxable income.

Although the standard deduction was further increased to Rs 50,000 in the 2019 interim budget for the current financial year, this still seems very inadequate if you look at the exemptions available to a consultant.

While the key exempt allowances — travel and medical reimbursement — no longer exist, the limits of the few that are still there have not been revised for years and remain unadjusted for rising inflation. For instance, the limits for children’s education allowance (Rs 100 per month per child, up to two children) and hostel allowance (Rs 300 per month per child, up to two children) were last revised almost two decades ago.

Now, look at what a consultant (engineer, doctor, lawyer etc) pays. If her gross receipts do not exceed Rs 50 lakh, she can opt for presumptive taxation and offer only 50% (or higher) of such gross receipts as taxable income.

In other words, 50% of the gross receipts can be claimed as expenses. If, the consultant wishes to claim a higher expenditure (that is, more than 50% of the gross receipts), it is mandatory to have the accounts audited.

Presumptive taxation benefit is not available if the gross receipts exceed Rs 50 lakh. In that case, the actual expenses as per the audited accounts are allowed as a deduction.

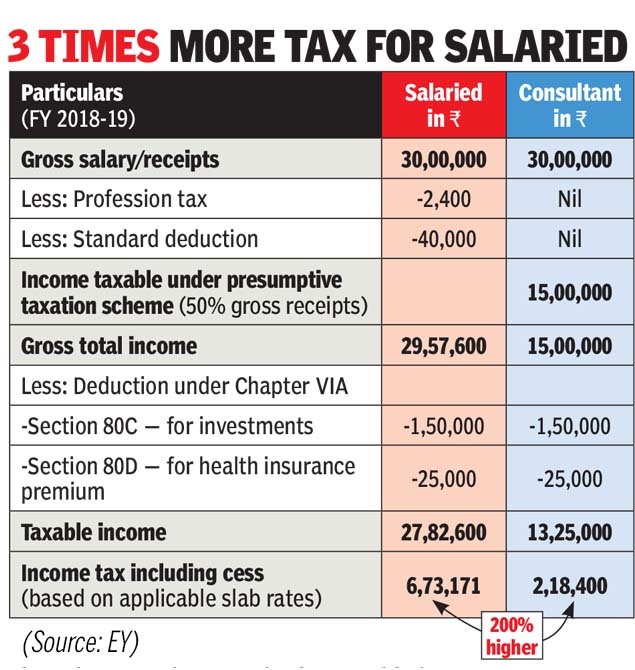

While the presumptive tax has really helped smaller and medium-sized taxpayers, it has resulted in stark disparity between salaried employees and consultants with the same income. This is reflected in a case study (I-T rates applicable for the financial year 2018-19 have been used in the illustration — see graphic).

Both the salaried employee and the consultant earn the same gross income (salary and gross fees) of Rs 30 lakh. The end result is horribly skewed against the salaried employee who pays Rs 6.73 lakh in taxes, while the consultant pays only Rs 2.18 lakh — that’s less than a third of the salaried employee’s tax liability. So, while both earn Rs 30 lakh, the salaried employee ends up paying Rs 4.55 lakh more in taxes.

Some countries like Denmark and South Korea provide deductions from salary income based on a certain percentage/income levels. In Denmark (for FY 2018), a salaried individual was eligible for a deduction of 9.5% of salary income, subject to a maximum of (Danish Krone) DKK 34,300. The minimum salary required to be eligible for it was DKK 361,053.