CHENNAI: Friend Assurance feature proposed by health insurance companies will now allow both friends and families to buy a health insurance policy, besides a discount awarded to the healthiest group.

Religare Health Insurance, Max Bupa Health Insurance and Kotak Mahindra General Insurance which had proposed the idea of ‘friend assurance’ under the Regulatory Sandbox had received Insurance Regulatory and Development Authority’s (IRDA) nod earlier this month.

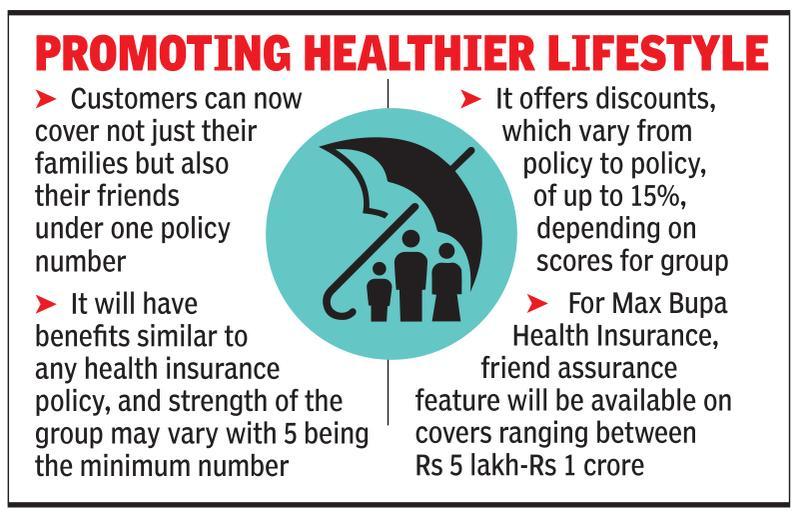

Under this policy, customers can now cover not just their families but also their friends under one policy number. “The objective is to acknowledge and reward people who lead a healthy life and so, why restrict only with the family. A 15% discount on premium at the time of renewal will be awarded if there are no claims made (for in-patient care) in the year,” said Religare Health Insurance, which will make this new addition on its existing Group Care product, and offer under Rs 5 lakh - Rs 10 lakh cover.

This new policy will have similar benefits of any health insurance policy, and strength of the group will vary between five to 30. Under this concept, the group will be given scores based on various behaviours like number of doctor consultations, number of health checkups based on which renewal premium will be decided.

Max Bupa Health Insurance has decided to roll out the friend assurance feature on its existing group policy — Health Companion. “Depending on the group’s cumulative score, we will decide the discount. We do estimate an average discount of 5%-10% if the entire group has a good score,” Max Bupa’s spokesperson said.

This friend assurance feature will be available on all its policies and on covers ranging between Rs 5 lakh and Rs 1 crore. “We have defined the group with a minimum of seven members, but no restriction on upper limit,” he added.